Inclusion of 100% the entities registered with the Fund

The Fund joined “Tamm” Platform

Continuation of the “Direct Debit” Project

Kafaat Project

Nabd

Electronic Linkage for Housing Loans Exemption

Entities Support Center

1- Customers Services

Smart Contributions increase Entities Compliance by 22%

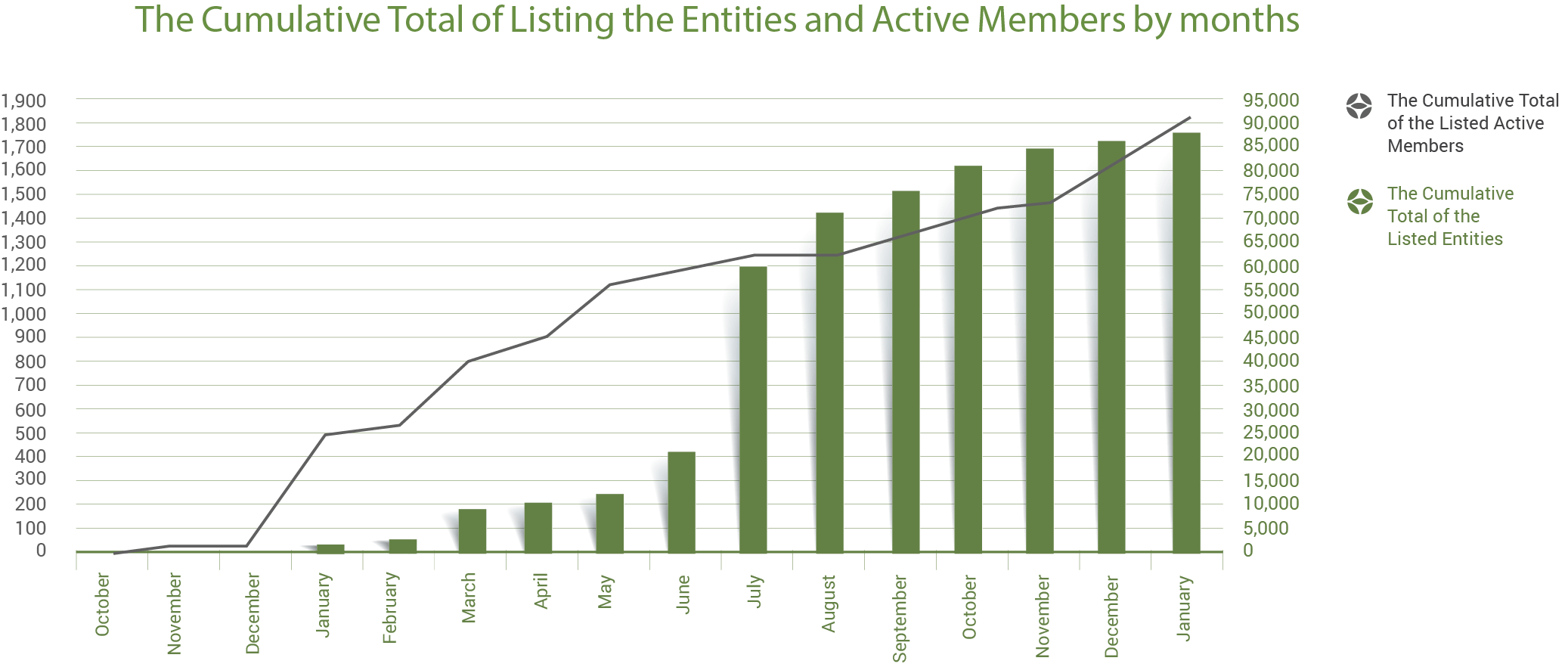

The (Covid-19) pandemic and the resulted exceptional circumstances have not affected or disrupted the Fund’s development projects. On the sidelines of the “Digital Month” initiative, which was launched by the Abu Dhabi government with the aim of enriching the customers experience and benefiting from the digital services provided by the government authorities in the emirate, the Fund announced the completion of the “Smart Contributions” project, which aims to reduce the time and effort of entities and raise their compliance with the Pension Law. Thus, directly contributing to preserving the pension rights of citizens, as well as providing retirement benefits to them without any delay and according to the international standards. 100% of the entities registered with the Fund have been included in the “Smart Contributions” project. the project resulted in a set of results, including an increase in the accuracy of the demographic data by 100%; an increase in the entities compliance rate by 22%; in addition to reducing the operational cost of government authorities by the equivalent of 1,320 working days and 82 working days for the Fund.

Automatic Application of the pensioners Exemption Requests from Housing Loans

The Fund always seeks to invest in successful partnerships with government institutions and authorities in the Emirate of Abu Dhabi, to provide all the possible facilities to customers. Among the most important fruits of cooperation with partners during the past year is the agreement which was made with the Abu Dhabi Housing Authority to submit exemption requests from housing loans “automatically” for the retired citizens with limited income, who are registered with the Fund, by activating an electronic linkage between Abu Dhabi Pension Fund and Abu Dhabi Housing Authority. The linkage will exempt the pensioners who wish to obtain an exemption from housing loans from bearing the burden of applying directly to the authority. The Fund will automatically apply on their behalf upon the retirement of the active member, provided that his pension does not exceed AED 20,000.

Direct Debit Increases the Entities Compliance

Collecting pension contributions is one of the basic tasks of the Fund. Accordingly, the Fund seeks to implement all its tasks and operations in smart and innovative ways. During 2020, the Fund introduced the service of “Direct Debit Payment” for the monthly pension contributions from the bank account of the entity, to collect the monthly contributions amounts, in order to preserve the pension rights of the active members. The service also aims to facilitate the monthly pension contributions payment while accurately matching them with the value entailed by them, thus saving time and effort and avoiding the imposition of any additional amounts, resulted from the payment delay. This service contributes to the speedy completion of services provided to the active members within the defined time.

New Decisions to Improve the Work Mechanism

The Fund has taken a number of decisions that will improve its operations, in a way that will positively affect the services provided to customers and raise their level of satisfaction. At the level of customers, a decision was taken on the possibility of registering the active members retroactively if not being registered by his entity for any reason, by simply addressing the Fund to process the request. Moreover, an amendment has been made regarding dealing with the contributions payment during leaves and absence from work, with the aim of preserving the rights of citizens registered with the Fund, according to which the entities became responsible for the contributions payment if the active member takes unpaid leave or is interrupted from work and then the situation was settled between them.

“Ajyal” Continuous Development Projects

For the second year in a row, the Fund continues to implement multiple projects under the "Ajyal" project, which was launched by the Fund in 2019. “Ajyal” is a development project which includes all the operations of the Fund, both internally and externally. “Ajyal” roadmap includes five projects, namely; Change Management Project, Organization Restructuring, Smart Contributions, Customers’ Accounts, Pensioners and Beneficiaries Pensions Management Project. The upcoming stages include many projects that will strongly contribute to the development of the Fund's services internally and externally.

Entities Support Center

Entities are the primary partner of the Fund in providing services and preserving the rights of citizens. Accordingly, the Fund is keen to support them with all the means in order to increase their compliance with the Pension Law requirements in the Emirate of Abu Dhabi, through awareness workshops and continuous communication. During last year, the Fund made its utmost best to expand the scope of the entities support channels, as an “Entity Service Center has been activated,” to facilitate all the procedures for them and complete the transactions of their registered employees with the Fund.

2- Internal Development

“Nabd” Supports Scientifically Based Decision-Making Processes

The availability of data and information is the first step of proper planning to ensure the quality of business. The Fund’s team designed the “Nabd” system to support decision-making on informational foundations, by providing all the data and information related to the Fund’s operations. Nabd’s work mechanism relies on linking all the adopted policies and methodologies in the Fund with the daily tasks of the employees.

The system specifies the requirements for excellence precisely to be included in the various operations before starting the implementation. It is also a link between the strategic plan of the Fund and all the main services and operations. Furthermore, it aims to apply the best practices and adopt the finest systems and programs to ensure quality and improvement. Through the program, the required time and effort to complete all the operations and propose improvement plans can be measured, as well as the expected productivity and costs of projects and operations.

“Kafaat” Develops the Team Skills

In fulfillment of the Fund’s strategy to provide pension services that enrich the experience of the customer and a sustainable financial system, the Higher Management of the Fund paid great attention to developing and stimulating human capital, which was embodied in planning and allocating the necessary resources for training and continuous development, as well as adopting the best international practices in this field.

During the past year, “Kafaat” project was created, which is a pioneering and innovative project. It is concerned with the process of training human cadres and its implementation, in terms of defining and identifying the training needs with high accuracy, according to the standards of operations, tasks and corporate culture, according to the levels which commensurate with the disparity in the level of employees. The project aims to develop training plans at the level of divisions and employees in terms of identifying the training competencies that each employee needs, based on the definition and determination of the required training competencies, according to the occupational level and degree, as well as the tasks and duties carried out by the employee, through an organizational structure based on participation between the employee and his line director and those in charge of training and development in the Fund, and by applying a mechanism to invest the knowledge experiences in the Fund.